do pastors get housing allowance

A housing allowance is often a common and critical portion of income for pastors. Tax Return for Seniors.

What To Do If Your Clergy Housing Allowance Exceeds Your Actual Expenses The Pastor S Wallet

According to the IRS the housing allowance of a retired minister counts because it is paid as compensation for past services.

. These allow ministers of the gospel to exempt all of their housing expenses from federal income taxes. The gross-up amount depends on the mortgage type and ranges from 15 25 higher than the actual check received. Regretfully the clergy has a difficult time getting qualified for a mortgage loan.

They would be taxed on salary minus living expenses. A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. Thats helpful to know because if you hear of a pastor with a 50k housing allowance that does not mean that he spends that much a year on his house.

Social Security Coverage The services you perform in the exercise of your ministry are generally covered by social security and Medicare under the self-employment tax system regardless of your status. Both the cash housing allowance and the parsonage allowance count as income when calculating Social Security retirement benefits. Those earnings that they use to calculate benefits DO include your housing allowance.

Most ministers shouldnt pay off their houses. Enter Excess allowance and the amount on the dotted line next to line 1. Individual Income Tax Return.

Why do pastors get a housing allowance. That can be worth quite a bit of money so who. The housing allowance for pastors is not and can never be a retroactive benefit.

Enter Excess allowance and the amount on the dotted line next to line 1. So if a pastor earns 80k a year he could designate that 50k or whatever of that as a housing. Because the income is nontaxable we can gross up the income.

Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. That means we can use a higher amount towards qualifying for a mortgage. So if youre receiving 5000 in a housing allowance and the fair market rental value of the home dips to 4000 you can only exclude 4000 from your gross income.

Why do pastors get a housing allowance. There are two ways pastors are paid housing allowances. Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040 US.

A housing allowance may include expenses related to renting purchasing which may consist of down payments or mortgage payments andor maintaining a clergy members current home. Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services. Other churches simply pay the pastor a housing allowance as part of his salary.

Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040 US. A housing allowance is often a common and critical portion of income for pastors. I dont think the IRS would consider 100 an hour reasonable compensation for your service.

Box 1 is 37500 Box 14 is 2500. The payments officially designated as a housing allowance must be used in the year received. It is a form of income to fully pay or at least allow a part of the expense to own or rent a home.

If your salary is 37500 and the housing allowance is 2500 for a total compensation of 40000. This story is likely to pick up steam in the media and my experience with this topic is that most people including many elders and pastors have no idea how housing allowances work or why they. The allowance must be provided in payment for services that are ordinarily the duties of a minister of the gospel.

Individual Income Tax Return or Form 1040-SR US. One of the greatest financial benefits available to pastors is the housing allowance exemption. Tax Return for Seniors.

The minister must include the amount of the fair rental value of a parsonage or the housing allowance for social security coverage purposes. Contributions you make to a church retirement plan usually a 403 b 9 as a pastor are a part of. In addition this is saving pastors a total of about 800 million a year.

So if a pastor earns 80k a year he could designate that 50k or whatever of that as a housing allowance. A housing allowance amount can be amended at any time during the year. Individual Income Tax Return or Form 1040-SR US.

The church board can designate a higher housing allowance amount at any time during the year but it cant designate it retroactively on any income that has already been paid to the minister. It may not encompass expenses incurred as the result of commercial properties or vacation homes Any items for inclusion must be personal in nature for the. Regretfully the clergy has a difficult time getting qualified for a mortgage loan.

According to Christianity Today 81 of full-time senior pastors take advantage of the housing allowance. They look at your top 35 years worth of earnings and add in zeroes if you have less than 35 years of work history. The ministers cash housing allowance and parsonage allowance.

Some churches have a parsonage a house for the pastor owned by the church and the pastor lives in that. In this situation that extra 1000 has to be included as part of your wages on line 7 of your Form 1040 US. Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

He could have conceivably designated his entire salary to be toward housing. Last week a federal judge ruled that the long standing practice of churches and synagoges mosques dioceses etc giving their pastors a housing allowance was unconstitutional. This comes in two forms.

There is an additional benefit to pastoral housing allowance. You may need to ask your treasurer for a corrected W-2. It is a form of income to fully pay or at least allow a part of the expense to own or rent a home.

For example suppose a minister has an annual salary of 50000 but their total housing allowance is 25000. Turbo Tax then correctly asks you how much you spent on housing. That means that if you only work ten hours a week at the church then you cannot claim a 50000 housing allowance.

The payments officially designated as a housing allowance must be used in the year received.

Ministers Housing Allowance Open Bible East

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Housing Allowance Worksheet Fill Online Printable Fillable Blank Pdffiller

How To Set The Pastor S Salary And Benefits Leaders Church

Why Do Pastors Get A Housing Allowance The Cripplegate

Everything Ministers Clergy Should Know About Their Housing Allowance

Housing Allowance Request Form Brokepastor

The Minister S Housing Allowance

Ultimate Guide To The Housing Allowance For Pastors Reachright

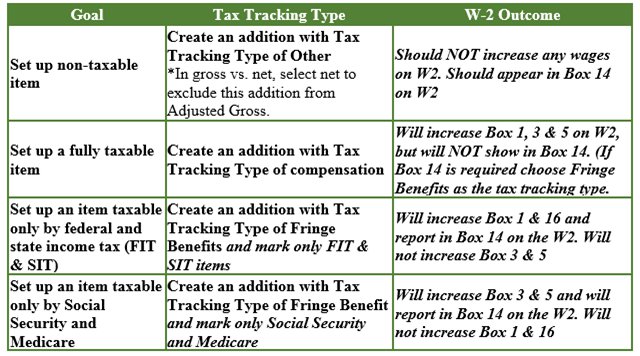

Payroll Set Up Housing Allowances For Clergy Members Insightfulaccountant Com

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books

Can I Claim A Pastor S Housing Allowance If I Live With My Parents The Pastor S Wallet

Top 5 Faqs Regarding Minister S Housing Allowance Baptist21

When Should A Pastor Request A Housing Allowance The Pastor S Wallet

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet